Inflation is a big problem facing small businesses across the nation. Let’s take a look at the reality of the situation, and how you can approach it while running your own small business.

A Concerning Situation

For nearly 50 years, The National Federation of Independent Businesses has released a survey on the state of small businesses in the US every year. According to their recent findings:

Small businesses confidence hovered near a two-year low in April, with the most owners since 1981 reporting that sky-high inflation was their single most important problem, a survey showed on Tuesday.

32% of respondents said that inflation was their single most important problem in running their businesses. NFIB chief economist Bill Dunkelberg told Fox Business:

CNBC reports mass jumps in both the consumer price index, which measures the price of goods and services, and the producer price index, which measures prices paid by wholesalers.

The first has increased by 8.5% and the latter increased by 11.2% since last March.

So, as a small business owner, what can you do to keep your business going strong in these challenging times?

An Interesting Phenomenon

In conditions like these, it seems obvious that small business owners would have to increase their prices. After all, it would appear that they have few other options.

Interestingly, a CNBC and SurveyMonkey Small Business Survey for Q2 of 2022 reveals the opposite.

Some 75% said they were experiencing a rise in the cost of their supplies, yet only 40% increased their prices. That was down from the 47% of owners who adjusted prices in the first quarter.

Creative Solutions To Coping With Inflation

According to the NFIB survey we referenced already, 31% of small business owners are taking on debt instead of raising their prices. That is simply not sustainable long-term.

Some small business owners are finding that a more focused and specialized approach can help. Some are limiting the quantity of goods or diversity of the services they offer to cope with inflation.

According to Jennifer Glanville, director of partnerships and collaborations at Boston Beer Company:

“Consumers are expecting to spend more whether we like it or not, but it’s really how we how we can help position these businesses for success around that and keeping some of their other costs down.”

Glanville is the head of Boston Beer Company’s Brewing The American Dream program. This initiative works with nonprofit lenders to help small businesses access capital.

It also offers business coaching for small business owners. Recently, one of their main focuses has been helping clients navigate inflation.

Some things that Glanville recommends are looking for ways to make ordering more efficient. She also says that focusing on networking in order to find support and possibly even the critical components of your business at a reduced cost.

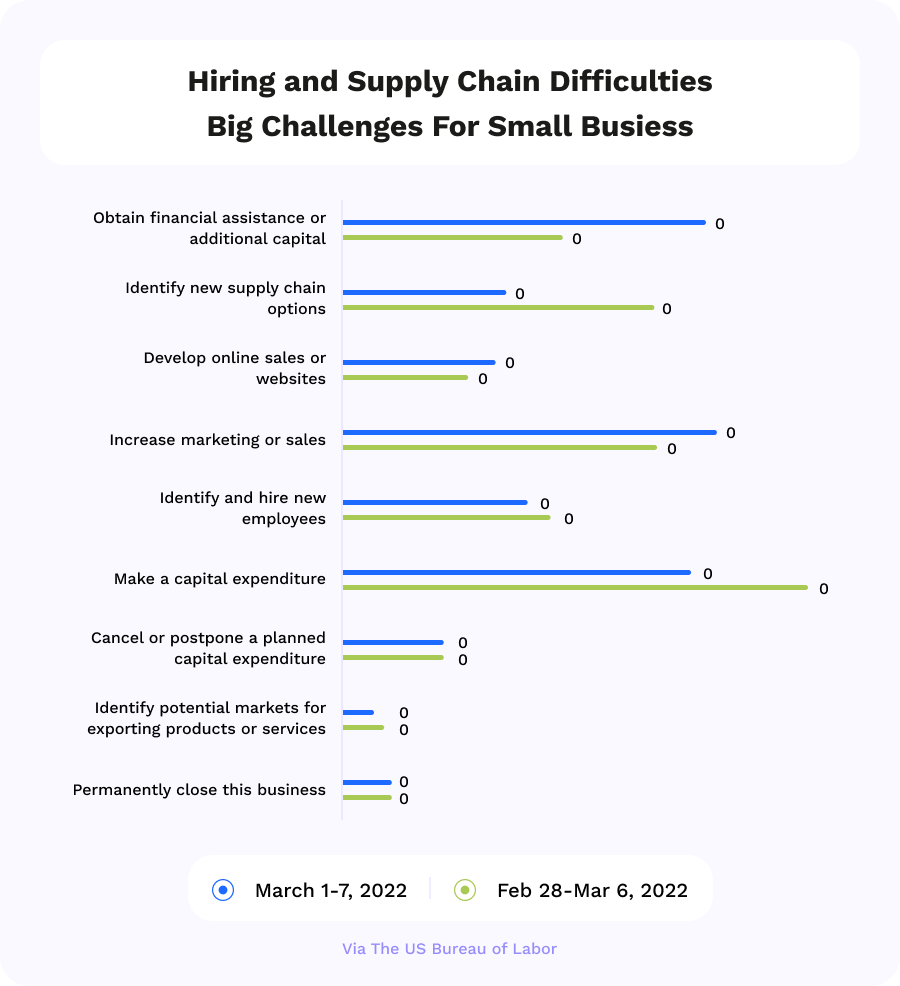

The “Labor Shortage” Is Hitting Small Businesses Harder

Something else small business owners, as well as the labor market in general, are struggling to cope with, is an “employee shortage.”

47% of businesses report that they cannot fill their open jobs. The Labor Department recently reported that there were over 11 million jobs open at the end of March 2021.

This is hitting small businesses extra hard. 93% have reported that few or no qualified individuals applied to fill their open positions.

This is definitely impacted by inflation.

Rising inflation is eating away at strong wage gains that American workers have seen in recent months: Real average hourly earnings decreased 0.8% in March from the previous month, as the 1.2% inflation increase eroded the 0.4% total wage gain, according to the Labor Department. On an annual basis, real earnings fell 2.7% in March.

Even if people work, they are often not paid enough to survive. This is a huge problem.

How One Small Business Owner Is Approaching Inflation To Keep Employees

In this environment, Mindy Godding, co-founder of Virginia-based in-home organization company Abundance Organizing, had to make some difficult decisions quickly to keep her business afloat.

She realized that with rising gas prices alone, and many employees that commuted upwards of an hour, they were spending up to $70 a day just to get back and forth from work.

A reality of many jobs is that they don’t pay employees enough to commute there, as gas prices skyrocket. Godding noticed the frustration of her employees and decided to act. She told CNBC:

“I was pretty certain we would start losing employees if we didn’t act in a real definitive way.”

As a band-aid, while Godding worked on raising wages, she gave employees $25 gas gift cards. A few weeks later, Abundance Organizing raised employee wages 25-30%. They did so by raising consumer prices.

According to Caleb Silver, editor-in-chief of Investopedia, small businesses are often seen as the ‘canary in the coal mine’ for the overall health of the US economy.

This means that if small businesses are struggling, it is an overall indicator of the health of the US economy as a whole. He says that:

“If the economy continues to slow, expect medium and large enterprises to feel this triad of economic woes even more than small businesses.”

Morale Is Low

According to the NFIB, the expectations of Small Business Owners for better conditions have fallen to a record low.

The NFIB’s Small Business Optimism Index was unchanged in April, holding at 93.2, the fourth straight month below the 48-year average of 98. Small business owners expecting better business conditions over the next six months decreased one point to a net negative 50%, the lowest level recorded in the survey’s 48-year history.

According to Caleb Silver, editor-in-chief of Investopedia, small businesses are often seen as the ‘canary in the coal mine’ for the overall health of the US economy.

This means that if small businesses are struggling, it is an overall indicator of the health of the US economy as a whole. He says that:

“If the economy continues to slow, expect medium and large enterprises to feel this triad of economic woes even more than small businesses.”

Final Thoughts on How Small Business Owners Can Cope With Inflation

It is truly a difficult time to be in business, and small business owners must be ready to make difficult and calculated decisions quickly to keep employees, keep clients and customers, and stay afloat.

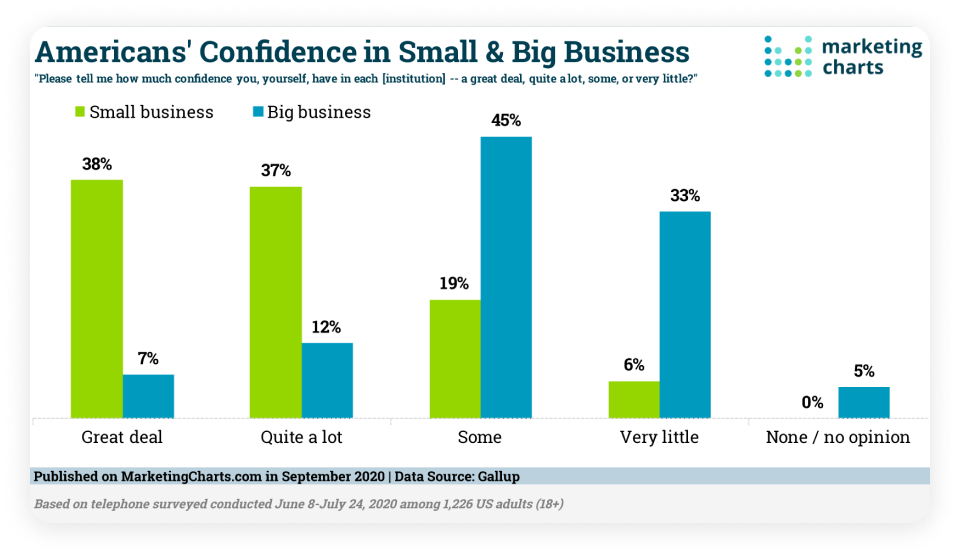

In general, it is common knowledge that prices are rising due to inflation. It seems that consumers are willing to pay for things that they find worthwhile or important. Also, data shows that Americans trust small businesses more than large companies and want to support them.

It also means that workers need higher wages if they are going to survive. Think about it, would you want to keep a job if the gas to get there cost more than what you earned? No one works to leave in debt at the end of the day.

As the costs of materials, products, rent, and labor rise, businesses simply have to restructure, network for valuable support, or raise prices.

However, there is good news. Regardless of inflation, the principles of what it takes to run a successful business are more or less the same. If you want to learn about and avoid some common mistakes, check out our blog post on the subject!

Also, as of summer 2023, many sources are reporting that the economy is starting to enter an upswing, which may point to a recovery for the US economy.

While things have been bumpy in the past few days, some are wondering if inflation is finally cooling enough for the federal reserve to raise interest rates.

What do you think? Comment below.

Since 2009, we have helped create 350+ next-generation apps for startups, Fortune 500s, growing businesses, and non-profits from around the globe. Think Partner, Not Agency.

Find us on social at #MakeItApp’n®